Case Study: End games of Import restrictions… Washing Machine, Dryers and Tariffs…

Equity Intelligence 21st April 2025

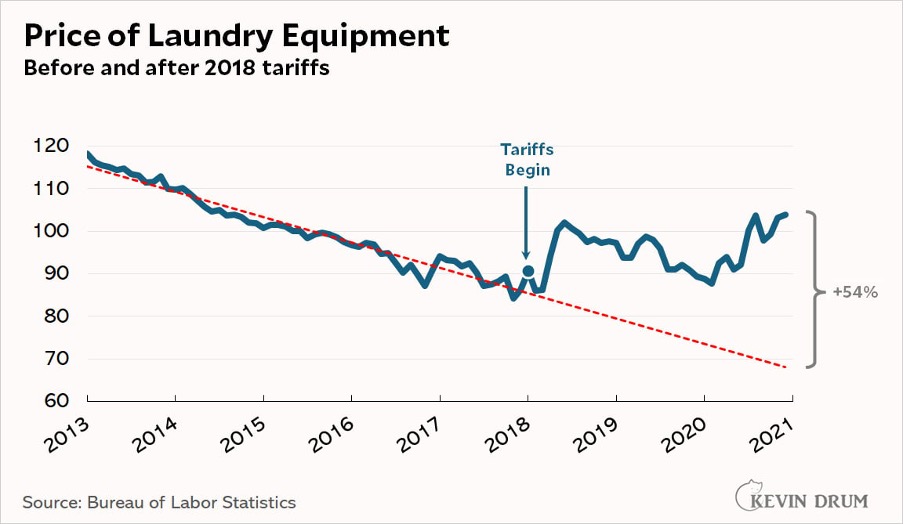

To understand how typical Tariff policies end up playing out in real world; one need not go very far. US import restriction of washing machines between 2012 and 2018 is very instructive.

The paper "The Production Relocation and Price Effects of U.S. Trade Policy: The Case of Washing Machines" by Flaaen, Hortaçsu, and Tintelnot examines the impact of U.S. import restrictions on washing machines between 2012 and 2018. Here are the key insights:

Price Effects of Tariffs:

- The 2018 global tariffs (applied to nearly all imported washers) caused a 12% price increase for both washers and dryers (a complementary good not directly taxed).

- This resulted in a tariff elasticity of consumer prices exceeding 100%, as domestic brands and dryer prices also rose.

Production Relocation:

- 2012 antidumping duties on South Korea/Mexico led manufacturers to shift production to China, lowering U.S. washer prices due to cheaper Chinese imports.

- 2016 tariffs on China prompted relocation to Thailand and Vietnam, stabilizing prices.

Domestic Market Dynamics:

- Domestic producers (e.g., Whirlpool) raised prices in tandem with imports, exploiting reduced competition.

- Domestic capacity creation did not rise significantly.

Critical Insights:

- Complementary Goods Impact: Dryer prices rose 12% despite no tariffs, revealing how trade policies can spill over to related markets.

Tariff Efficacy:

- Targeted tariffs (2012, 2016) failed to protect domestic industries long-term due to production shifting, whereas broad 2018 tariffs caused direct consumer harm.

- Consumer Burden: The 2018 tariffs cost U.S. households $1.5 billion annually—over 18 times the $82 million in tariff revenue collected.

For investors, this precedent signals three risks under the 2025 tariffs:

- Supply Chain Volatility: Production may relocate to secondary countries (e.g., Southeast Asia or Eastern Europe), but retaliatory tariffs could disrupt these shifts, prolonging uncertainty.

- Domestic Pricing Power: Firms in protected sectors might raise prices beyond tariff-driven costs, as seen in the washer market, squeezing consumer demand and margins for downstream industries.

- Inefficiency of Job Creation: The 2018 tariffs created 1,800 jobs at a cost of $817,000 per job annually—a poor return on capital that could recur if 2025 policies prioritize political optics over economic logic.

The study highlights how tariffs often distort markets more than they protect them, with costs disproportionately borne by consumers and adaptable multinationals. Investors should monitor sectors with inelastic demand (e.g., healthcare, staples, energy, tech hardware etc) for similar price spillovers and favour firms with agile global supply chains capable of strategic recalibration.

Source of the Paper : https://www.nber.org/system/files/working_papers/w25767/w25767.pdf