EQ Saturday Sapience #135

Equity Intelligence 6th September 2025

Quote for the Week

“Speculative approaches—which pay little or no attention to downside risk—are especially popular in rising markets. In heady times, few are sufficiently disciplined to maintain strict standards of valuation and risk aversion, especially when most of those abandoning such standards are quickly getting rich. After all, it is easy to confuse genius with a bull market.” —Seth Klarman

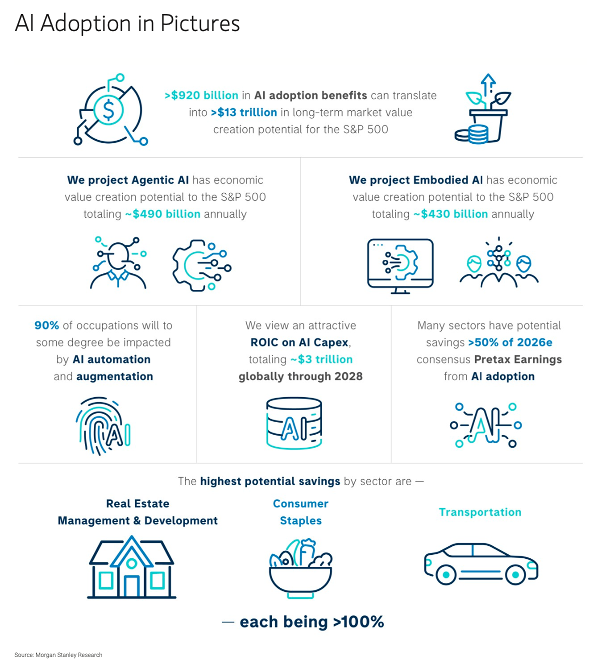

Picture for the Week

Podcast for the Week

Nikhil Kamath Podcast with Ruchir Sharma the author, investor and economist to discuss the forces shaping the world’s economy, where India fits in the new world order, and all things geopolitics… Watch more

Articles for the Week

Indian companies have cash worth INR10.7 lakh crore. Yet, they lag behind households and the government in driving capex. Why are corporates holding back despite cash-rich balance sheets and easy funding avenues?... Read more

India’s defence transformation is not optional; it is existential. Policies like Defence Acquisition Procedure (DAP) 2020 and reserving 75% of capital procurement for domestic sources have laid the foundation for increased indigenous production. Yet, the journey towards full-spectrum self-reliance is far from complete… Read more

The Evidence That AI Is Destroying Jobs For Young People Just Got Stronger. A big nerd debate with bigger implications for the future of work, technology, and the economy… Read more

Disclaimer:

The content of this newsletter include links to third-party websites as a convenience, and the inclusion of such links does not imply any endorsement, approval, investigation, verification or monitoring by Equity Intelligence India Pvt Ltd. If you choose to visit the linked sites, you do so at your own risk, and you will be subject to such sites' terms of use and privacy policies. Nothing in this newsletter should be construed as investment advice. The information contained herein is only as current as of the date indicated and may be superseded by subsequent market events or for other reasons. There is no guarantee that the information supplied is accurate, complete, or timely.